Getting The Ach Payment Solution To Work

EFT repayments (EFT stands for digital funds transfer) can be made use of reciprocally with ACH repayments. They both define the exact same payments mechanism.:-: Pros Cost: ACH repayments tend to be cheaper than cable transfers Rate: faster considering that they do not utilize a "batch" process Disadvantages Speed: ACH payments can take a number of days to refine Expense: fairly costly source: There are 2 kinds of ACH repayments.

ACH credit history purchases allow you "press" money to different financial institutions (either your own or to others). They utilize ACH credit purchases to push money to their workers' bank accounts at assigned pay durations.

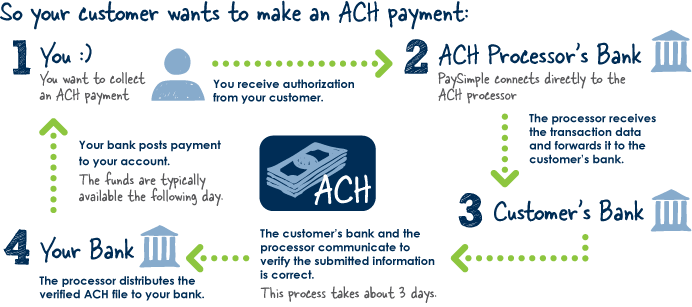

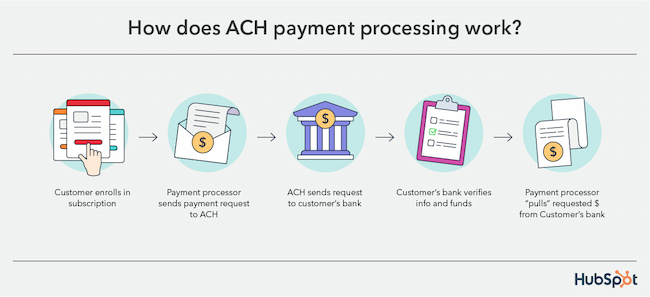

Consumers that pay a service (claim, their insurance provider or mortgage lending institution) at particular periods might choose to register for repeating repayments. That offers the service the capacity to launch ACH debit purchases at each invoicing cycle, drawing the quantity owed straight from the customer's account. Apart from the Automated Cleaning Home network (which connects all the banks in the United States), there are three other players involved in ACH repayments: The Originating Depository Financial Organization (ODFI) is the financial institution that launches the purchase.

The 2-Minute Rule for Ach Payment Solution

The National Automated Clearing Residence Association (NACHA) is the nonpartisan governmental entity in charge of managing and controling the ACH network (ach payment solution). Allow's take your automated monthly phone costs repayments as an example. When you authorize up for autopay with your telephone company, you supply your bank account information (transmitting and also account number) and also sign a repeating settlement consent.

Both financial institutions then communicate to make sure that there suffice funds in your checking account to process the deal. If you have enough funds, the transaction is refined and the cash is directed to your communications provider's savings account. ACH payments typically take several company days (the days on which financial institutions are open) to undergo.

, economic institutions can choose to have ACH credit scores refined and also supplied either within a company day or in one to 2 days. ACH debit purchases, on the various other hand, should be refined by the following service day.

A brand-new regulation by NACHA (which went right into effect in September 2016) calls for our website that the ACH procedure debits 3 times a day rather of simply one. The modifications (which are occurring in phases) will enable prevalent use of same-day ACH payments by March 2018. ACH settlements are normally more economical for companies to process than debt cards.

Fascination About Ach Payment Solution

Some ACH processors charge a level price, which usually varies from $0. 5 percent to one percent per purchase. Carriers may likewise bill an additional month-to-month charge for ACH repayments, which can differ.

These decline codes are essential for giving the right info to your customers as site to why their repayment didn't undergo (ach payment solution). Here are the 4 most usual decline codes: This suggests the client didn't have enough cash in their account to cover the quantity of the debit entry. When you get this code, you're probably going to need to rerun the transaction after the customer transfers more cash right into their account or supplies a various settlement method.

It's likely they forgot to inform you of the adjustment. They need to give you with a brand-new checking account to process the deal. This code is set off when some mix of the information offered (the account number and name on the account) does not match the financial institution's records or a missing account number was gone into.

In this instance, the client needs to offer their financial institution with your ACH Originator ID to enable ACH withdrawals by your business. Declined ACH payments can land your service a fine cost.

A Biased View of Ach Payment Solution

To avoid the use this link problem of untangling ACH declines, it might deserve just approving ACH payments from trusted clients. The ACH network is taken care of by the federal government and NACHA, ACH repayments don't have to comply with the very same PCI-compliance guidelines required for charge card handling. Nonetheless, NACHA calls for that all parties associated with ACH deals (including companies starting the repayments as well as third-party processors) execute processes, procedures, and controls to protect sensitive information.

That suggests you can not send or receive bank details using unencrypted e-mail or insecure internet types. Ensure that if you make use of a third event for ACH payment handling, it has actually applied systems with advanced encryption approaches. Under the NACHA regulations, originators of ACH settlements should additionally take "commercially affordable" steps to make sure the credibility of customer identification and routing numbers, as well as to determine possible deceptive activity.